Discounted Cash Flow (DCF) analysis is a core method in financial valuation, pivotal in determining whether an investment — such as the acquisition of a company — is economically justified. In the world of Mergers and Acquisitions (M&A), DCF analysis helps investors, corporate acquirers, and advisors estimate the intrinsic value of a target company by projecting its future free cash flows and discounting them back to present value using an appropriate discount rate, typically the Weighted Average Cost of Capital (WACC).

Understanding and applying DCF analysis correctly can mean the difference between a profitable acquisition and a costly misstep.

Definition and Core Concept

What Is DCF Analysis?

At its core, DCF analysis estimates the present value (PV) of an asset based on its expected future cash flows. These cash flows are “discounted” to reflect the time value of money — a foundational concept in finance which recognizes that a dollar today is worth more than a dollar tomorrow due to its earning potential.

Definition:

DCF analysis is a valuation method estimating the present value of future cash flows, widely used to determine if a target’s price aligns with its intrinsic value.

In the M&A context, DCF helps answer a fundamental question:

Is the price offered for the target company justified by its ability to generate cash in the future?

Components of DCF Analysis in M&A

To conduct a DCF analysis in a merger or acquisition, several key inputs and assumptions are required:

- Projection of Free Cash Flows (FCF)

- Free Cash Flow is typically calculated as:

FCF=EBIT×(1−Tax Rate)+Depreciation/Amortization−CapEx−Working Capital

- Analysts project FCF for 5–10 years based on the target’s historical performance, industry outlook, and strategic plans.

- This includes revenue forecasts, cost assumptions, capital expenditures, and working capital needs.

2. Terminal Value

- After the explicit forecast period, a terminal value is calculated to account for the value beyond the projection horizon.

- Two methods:

– Gordon Growth Model (Perpetuity Growth Method)

– Exit Multiple Method (based on EBITDA or EBIT)

3. Discount Rate (WACC)

- Reflects the required return for all investors (equity and debt).

- WACC = (E/V × Re) + (D/V × Rd × (1 – Tc))

- E = Market value of equity

- D = Market value of debt

- Re = Cost of equity

- Rd = Cost of debt

- Tc = Corporate tax rate

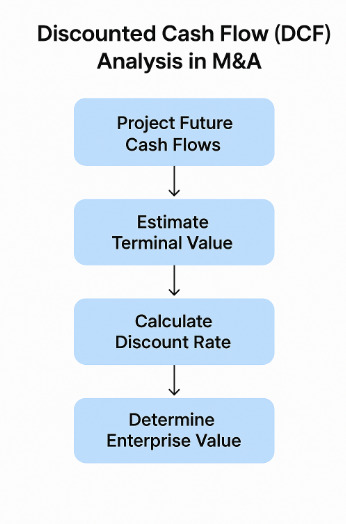

Steps in Conducting DCF for M&A

- Forecast FCFs (usually 5–10 years)

- Estimate terminal value

- Calculate WACC

- Discount all cash flows and terminal value back to present

- Sum the present values to get the enterprise value

- Subtract net debt to get equity value

- Compare this to the proposed acquisition price

Why DCF Matters in M&A

Strategic Acquirers

Companies pursuing strategic M&A (e.g., Amazon acquiring Whole Foods) use DCF to assess:

- Whether synergies justify the premium paid

- Whether the acquisition aligns with their strategic and financial objectives

Financial Sponsors / Private Equity

Private equity firms are highly reliant on DCF:

- To evaluate if returns (IRR) meet hurdle rates

- To plan entry and exit strategies

Strengths and Limitations

Strengths

- Based on fundamentals, uses real expected cash flows

- Flexible and customizable to different scenarios

- Allows sensitivity and scenario analysis (e.g., best/worst case)

Limitations

- Highly sensitive to assumptions (especially WACC, terminal value)

- Can give a false sense of precision

- Requires robust and credible financial projections

Real-World Examples of DCF in M&A

- Disney’s Acquisition of 21st Century Fox (2019)

- Deal value: $71.3 billion

- DCF Role: Analysts emphasized synergies — Disney projected significant cost savings and revenue generation from combined media content and streaming capabilities (e.g., Disney+).

- Disney’s management justified the price based on future cash flows from global IP leverage.

- Microsoft’s Acquisition of LinkedIn (2016)

- Deal value: $26.2 billion

- Microsoft used DCF to evaluate LinkedIn’s future monetization potential (advertising, premium services).

- While the price seemed high (~10x revenue), the DCF suggested the deal would be accretive over time through synergies and user growth.

- Kraft-Heinz’s Attempted Acquisition of Unilever (2017)

- Proposed value: ~$143 billion

- Outcome: Rejected by Unilever as undervalued

- Unilever’s own DCF-based valuation, which likely accounted for long-term sustainability and emerging markets growth, implied that Kraft-Heinz’s offer didn’t reflect its intrinsic value.

- Dell’s Buyout of EMC (2016)

- Deal value: $67 billion (largest tech deal at the time)

- Complex DCF modeling was used to value EMC and its stake in VMware.

- The structure of the deal reflected the differing cash flows and risk profiles of the two companies.

Sensitivity and Scenario Analysis in M&A

Because of the reliance on future projections, DCF models in M&A must include sensitivity analysis — showing how valuation changes with different assumptions:

- Revenue growth

- WACC changes

- Terminal growth rate

- Margin assumptions

This allows decision-makers to understand risks and valuation ranges rather than relying on a single point estimate.

DCF vs. Other Valuation Methods in M&A

| Method | Description | Use in M&A |

| DCF Analysis | Intrinsic, forward-looking valuation | Best for long-term investors; synergy modeling |

| Comparable Companies (Comps) | Relative valuation based on peers | Good for benchmarking market sentiment |

| Precedent Transactions | Values based on similar past M&A deals | Useful for negotiation and setting price floor/ceiling |

| Asset-based Valuation | Focuses on balance sheet value | Rare in M&A unless liquidation involved |

In practice, M&A advisors use all these methods — but DCF is often considered the anchor of valuation analysis.

Conclusion

Discounted Cash Flow (DCF) analysis is a powerful tool in the M&A toolkit. It provides a structured, intrinsic valuation that is especially useful when deals are large, strategic, and based on long-term expectations. While its precision can be misleading if inputs are weak or assumptions flawed, when applied rigorously, DCF analysis helps acquirers avoid overpaying — and sellers avoid underselling — based on hard financial logic.

Mastering DCF is not optional — it’s essential. In a world where billions are won or lost on forward-looking expectations, the ability to model and interpret discounted cash flows can determine the outcome of some of the most significant business decisions.