In Mergers and Acquisitions (M&A), deal structures often include creative solutions to bridge the gap between a buyer’s willingness to pay and a seller’s expectations. One such mechanism is the deferred payment. Today, we’ll dive into what deferred payment means, why it is used, and how it has played out in notable real-world transactions.

Definition of Deferred Payment

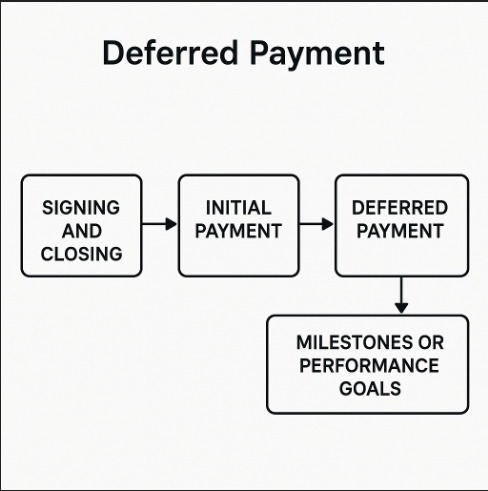

Deferred payment refers to a structure in which a portion of the purchase price is not paid at the time of the transaction’s closing. Instead, payment is delayed until a future date, usually contingent on the achievement of specific milestones or performance goals.

Think of it this way: the buyer and seller agree on a total value for the company, but instead of paying it all upfront, the buyer withholds a portion and will only pay it later if certain conditions are met. This arrangement can make deals happen when buyers are cautious, and sellers are confident about their future growth.

Why Use Deferred Payment in M&A?

There are several strategic reasons why deferred payments are commonly used:

- Risk Mitigation:

Buyers may worry that the target company will not perform as expected post-acquisition. By tying part of the price to future performance, the buyer shares this risk with the seller. - Bridging Valuation Gaps:

Often, buyers and sellers have different views about a company’s value, particularly about its growth prospects. Deferred payments can “bridge” this gap. - Cash Flow Management:

Buyers may want to spread out payments to better manage their cash flow. - Incentivizing Performance:

Sellers (especially if they stay on to manage the business) are motivated to ensure the company hits performance targets to receive their full payout.

Common Forms of Deferred Payments

- Earnouts:

The most popular form. Here, additional payments are made based on the business hitting financial targets (e.g., revenue, EBITDA) over a defined period. - Promissory Notes:

The buyer issues a formal note promising to pay a certain amount at a future date, sometimes with interest. - Installment Payments:

The payment is simply spread over several future dates, regardless of performance.

Real-World Examples of Deferred Payments

Let’s explore a few notable M&A transactions that used deferred payments:

1. Google’s Acquisition of Nest Labs (2014)

When Google acquired Nest Labs (makers of smart thermostats and smoke detectors) for $3.2 billion, part of the deal included performance-based bonuses for the founders and key employees. Although most of the payment was upfront, additional deferred payments were structured based on product milestones and market performance.

This ensured that Nest’s leadership had continued incentives to innovate even after joining a much larger company.

2. Bristol-Myers Squibb’s Acquisition of Celgene (2019)

This was one of the largest biotech deals ever, valued at approximately $74 billion.

In this deal, Celgene shareholders received:

- Cash and Bristol-Myers shares at closing,

- Plus a special Contingent Value Right (CVR).

The CVR was a deferred payment structure: shareholders would receive an extra $9 per share if Celgene’s key drugs achieved regulatory approval milestones within a certain timeframe.

Thus, part of the deal value was contingent on future regulatory success — a critical risk in the pharmaceutical industry.

(Important note: the CVR ultimately expired worthless because the milestones were not achieved on time.)

3. Facebook’s Acquisition of WhatsApp (2014)

When Facebook acquired WhatsApp for approximately $19 billion, part of the price was paid in cash and stock at closing, but restricted stock units (RSUs) were issued to WhatsApp employees with a deferred vesting schedule over four years.

While not a typical earnout tied to financial performance, it was a deferred incentive to ensure key talent stayed on and helped the company integrate successfully.

Potential Pitfalls of Deferred Payment Structures

While deferred payments can be powerful tools, they are not without challenges:

- Disputes over performance metrics:

Parties may later argue whether milestones were met, particularly if the criteria were vaguely defined. - Integration Risks:

If the acquired company is quickly merged into the buyer’s operations, it can be difficult to isolate its performance for measuring targets. - Employee Turnover:

Deferred payments tied to milestones often assume continuity of key staff. If they leave, reaching the targets can become harder. - Litigation:

Earnout disputes are one of the most common causes of post-M&A lawsuits.

Thus, clarity in drafting the deferred payment agreement is absolutely crucial.

Conclusion

In summary, deferred payment structures in M&A allow for flexibility, risk-sharing, and performance alignment between buyers and sellers. They are particularly useful in industries where future performance is uncertain or difficult to predict.

However, while they can help bridge differences and get deals done, careful drafting, clear metrics, and thorough planning are essential to avoid post-deal disputes.

In today’s competitive M&A environment, a smart use of deferred payments can be the key to balancing risk and reward — and to crafting deals that work for everyone involved.