Definition and Importance

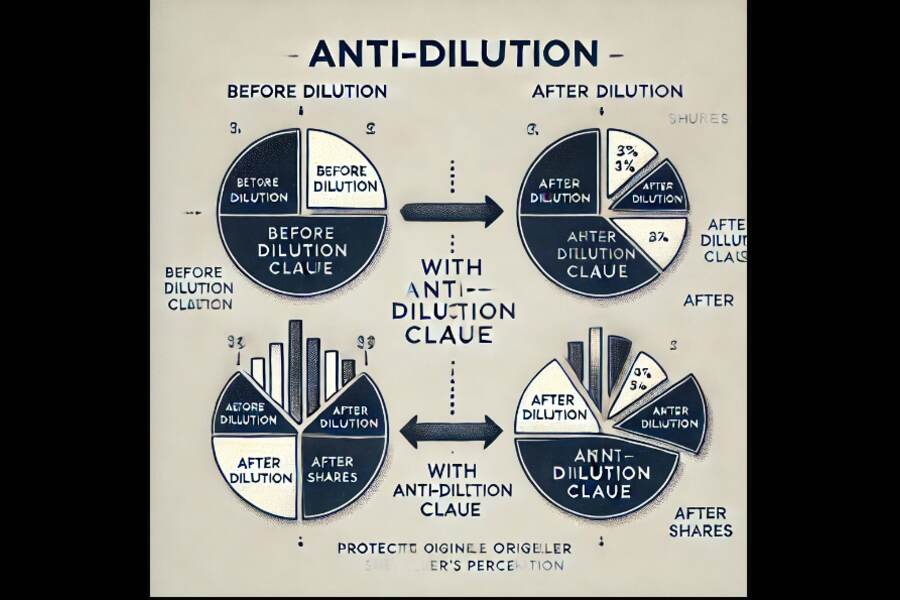

An anti-dilution clause is a contractual provision that protects existing shareholders from a decrease in their ownership percentage when new shares are issued at a lower price than the price they originally paid. This clause is particularly significant for early investors, as it ensures their investment retains value in cases where a company raises additional funding at a reduced valuation.

How It Works

In mergers and acquisitions (M&A), an anti-dilution clause becomes critical when a company issues new shares in financing rounds at a price lower than the price paid by earlier investors. If no protection is in place, early investors would see their shareholding diluted, reducing their control and potential returns. The clause acts as a safeguard, adjusting the number or price of shares held by existing investors to compensate for this dilution.

Types of Anti-Dilution Protection

There are two main types of anti-dilution protection:

- Full Ratchet Anti-Dilution Protection: This method adjusts the conversion price of preferred shares to match the new lower share price. For example, if an investor initially bought shares at $5 per share and the company later issues shares at $2 per share, the conversion price of the preferred shares will be adjusted to $2. This mechanism benefits early investors but can be unfavorable to common shareholders, as it heavily dilutes their stake.

- Weighted Average Anti-Dilution Protection: This approach provides a more balanced adjustment. It considers the total number of shares before and after the new issuance and adjusts the conversion price accordingly. This method is less aggressive than full ratchet and is commonly used in venture capital agreements. The formula used in weighted average protection can be either:

- Broad-Based Weighted Average: Includes all outstanding shares in the calculation.

- Narrow-Based Weighted Average: Only considers a limited portion of outstanding shares, often favoring preferred shareholders.

Role in Mergers and Acquisitions

During an M&A transaction, an anti-dilution clause can significantly influence negotiations. If an acquiring company plans to issue new shares as part of the deal, existing investors with anti-dilution protection may require adjustments to maintain their shareholding value. This can affect:

- Shareholder Agreements: Investors may renegotiate their positions to ensure they receive fair value during the acquisition.

- Valuation Considerations: The presence of anti-dilution provisions can influence the company’s valuation, as potential investors or buyers must account for possible share adjustments.

- Deal Structuring: Acquirers may need to adjust the structure of the deal, such as offering additional consideration or restructuring equity issuance to satisfy existing investors.

Conclusion

The anti-dilution clause is a crucial component of investment agreements, particularly in M&A transactions. It ensures that early investors are not unfairly disadvantaged if new shares are issued at a lower price. Understanding the different types of anti-dilution protection—full ratchet and weighted average—is essential for investors, founders, and acquiring companies. By carefully negotiating these clauses, all parties can achieve a fair and balanced outcome in financing rounds and acquisitions.

Check for more related Mergers and Acquisitions terms on our Glossary page.