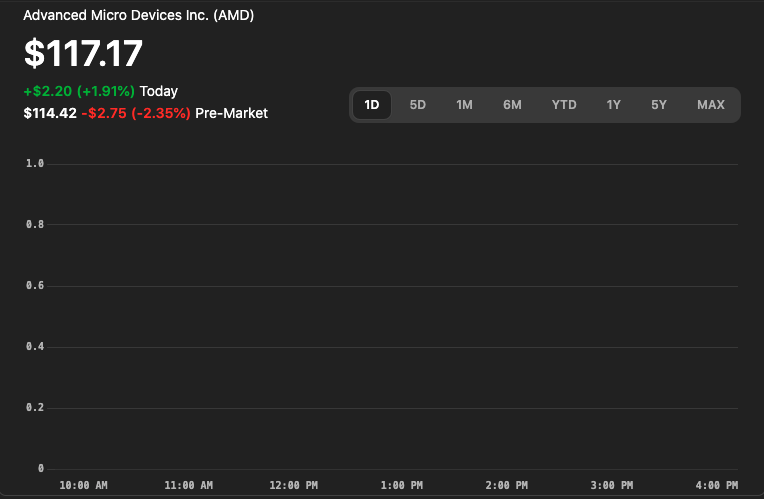

On May 19, 2025, Advanced Micro Devices (AMD) announced a definitive agreement to sell the data center infrastructure manufacturing business of its recent acquisition, ZT Systems, to Sanmina Corporation for up to $3 billion. This strategic divestiture aligns with AMD’s focus on AI system design and accelerates Sanmina’s expansion into the high-growth cloud and AI infrastructure market.

Deal Structure and Strategic Rationale

The transaction comprises $2.25 billion in cash, a $300 million premium split equally between cash and equity, and an additional $450 million contingent upon the business’s financial performance over the next three years. This move follows AMD’s $4.9 billion acquisition of ZT Systems in March 2025, where AMD had indicated plans to divest the server manufacturing segment post-acquisition.

Through this deal, Sanmina becomes AMD’s preferred new product introduction (NPI) manufacturing partner for AI computing systems. AMD retains ZT Systems’ design and customer enablement teams, enhancing its capabilities in delivering high-performance AI solutions to cloud customers.

Company Profiles

Advanced Micro Devices (AMD): A leading semiconductor company based in Santa Clara, California, AMD specializes in high-performance computing and graphics solutions. The acquisition of ZT Systems was part of AMD’s strategy to strengthen its position in the AI data center market and compete more effectively with industry leader Nvidia.

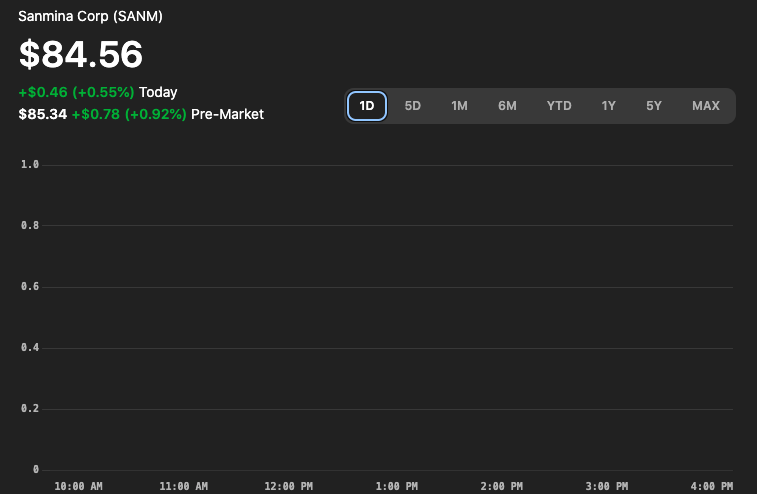

Sanmina Corporation: Headquartered in San Jose, California, Sanmina is a global provider of integrated manufacturing solutions, including design, engineering, and logistics services. The acquisition of ZT Systems’ manufacturing business significantly enhances Sanmina’s capabilities in the cloud and AI infrastructure sectors.

Impact and Outlook

The acquisition is expected to double Sanmina’s revenue scale within three years, adding an estimated $5–6 billion in annual revenue run-rate. ZT Systems brings advanced liquid cooling capabilities and over 30 years of systems integration experience, with manufacturing facilities in New Jersey, Texas, and the Netherlands.

Sanmina anticipates the transaction to be accretive to its non-GAAP earnings per share in the first-year post-closing. The deal is subject to regulatory approvals and customary closing conditions, with completion expected by the end of 2025.