Hewlett Packard Enterprise (HPE), headquartered in Spring, Texas, is a global technology leader specializing in delivering intelligent solutions across networking, hybrid cloud, and artificial intelligence (AI).

Since its spin-off from Hewlett-Packard in 2015, Hewlett Packard Enterprise (HPE) has carved out a powerful niche in the world of enterprise IT. Focused on edge-to-cloud solutions, AI, hybrid cloud, and high-performance computing, HPE has used mergers and acquisitions (M&A) as a critical lever to fuel innovation and drive growth. Let’s take a closer look at HPE’s biggest moves, why they matter, and what the future holds.

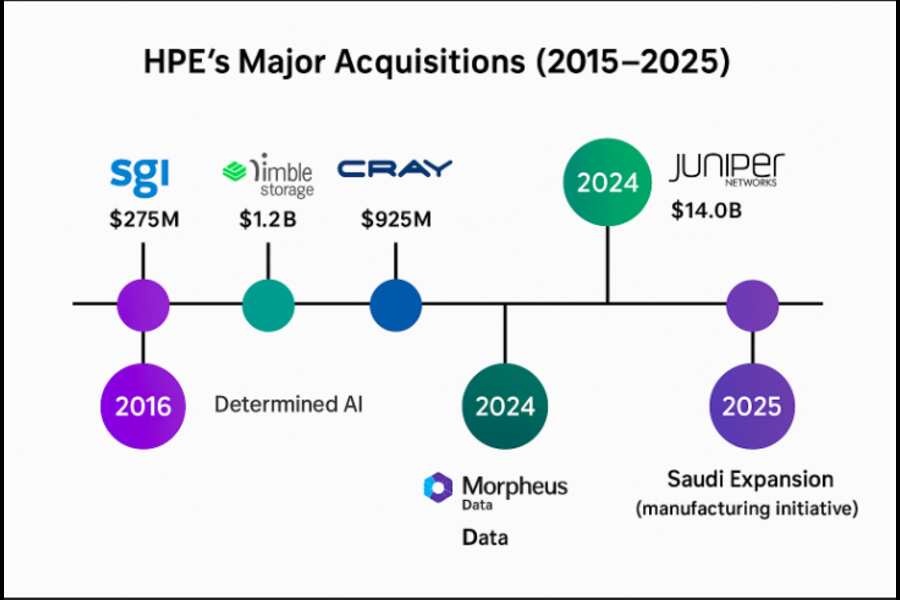

A Look Back: The 10 Acquisitions That Shaped HPE

Over the last decade, HPE has been on a steady M&A path, targeting companies that expand its capabilities and deepen its value to enterprise customers. Here’s a snapshot of some of the most important deals:

- Juniper Networks (2024) – Acquired for a massive $14 billion, this move strengthens HPE’s networking dominance, especially in AI-powered networks and cloud-native architecture.

- Morpheus Data (2024) – A key addition to the GreenLake portfolio, Morpheus simplifies hybrid cloud operations—critical for organizations juggling public, private, and on-prem infrastructure.

- Athonet (2023) – A play into private 5G, Athonet helps HPE meet growing demand for secure, local, and high-performance wireless networks.

- OpsRamp (2023) – This acquisition boosted HPE’s IT operations management capabilities, helping customers manage complex hybrid environments.

- Determined AI (2021) – With this startup, HPE bolstered its AI/ML capabilities, making it easier to train and deploy large-scale models on-prem or in the cloud.

- Silver Peak (2020) – Acquired for $925 million, Silver Peak supercharged Aruba’s SD-WAN offerings, pushing HPE’s edge strategy even further.

- Cray Inc. (2019) – At $1.3 billion, this was a transformative deal, bringing HPE to the forefront of high-performance computing and exascale systems.

- BlueData (2018) – Brought container-based analytics platforms into HPE’s fold, helping companies manage big data in new ways.

- Nimble Storage (2017) – This $1.2 billion acquisition introduced predictive analytics to enterprise storage via InfoSight.

- SGI (2016) – For $275 million, SGI added powerful big data and HPC capabilities to HPE’s compute business.

Selling to Focus: Key Divestitures

HPE has also been unafraid to slim down when it means sharpening focus. In 2016, it sold its stake in Mphasis to Blackstone for $825 million, while maintaining a commercial relationship. And earlier, it spun off its enterprise services unit to merge with CSC, creating DXC Technology. While DXC faced its own challenges, for HPE the move was part of a broader shift to double down on infrastructure and platform innovation.

Recent Moves: What’s New in 2024–2025?

It’s been a busy couple of years for HPE:

- Juniper Networks acquisition (2024) was undoubtedly a headline grabber. It gives HPE a huge boost in the cloud networking space and positions it as a serious competitor to Cisco and Arista.

- Morpheus Data (2024) quietly made waves. Its hybrid cloud orchestration tools now power simplified, self-service IT under HPE GreenLake—a big win for IT teams worldwide.

- In 2025, HPE expanded its “Saudi Made” initiative to include HPE Aruba Networking, aligning with Vision 2030 and investing in local manufacturing, jobs, and innovation in the Middle East.

So far, these moves are paying off, though integrating a giant like Juniper will take time. HPE’s track record with previous integrations (Nimble, Cray, Silver Peak) shows it has the chops.

Why These Deals? HPE’s Strategy Explained

Every move HPE makes ties into a few big-picture themes:

- Hybrid cloud leadership – With GreenLake as the crown jewel, HPE wants to be the go-to platform for managing multi-cloud and edge infrastructure.

- AI & high-performance computing – Through Cray and Determined AI, HPE is ready for the age of AI and scientific computing at scale.

- Edge-to-cloud transformation – With Silver Peak, Athonet, and Aruba, HPE is leading the charge at the edge, where data is increasingly created and consumed.

- Sustainability and localization – Initiatives like the Saudi expansion reflect a broader goal: building green, sovereign, and future-ready IT infrastructure.

Final Thoughts: What’s Next for HPE?

HPE’s approach to M&A has evolved from broad consolidation to laser-focused bets that extend its edge, AI, and cloud leadership. As enterprise tech gets more complex, HPE is positioning itself as a simplifier—offering customers flexible, intelligent solutions through an ecosystem of powerful acquisitions.

And with big bets like Juniper and Morpheus now in play, it’s clear HPE is not done yet.